Ira growth calculator

The after-tax cost of contributing to your. The Roth IRA and the traditional IRA.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction.

. While long term savings in a Roth IRA may produce. Use this Roth vs. How much can you really benefit from an IRA.

Unfortunately there are limits to how much you can save in an IRA. Enter details of your current IRA balance age retirement plans and. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you. Free Roth IRA calculator to project how much youll need in retirement. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600.

Learn How We Can Help. See how this kind of investment can help you achieve your financial goals. On this page is an IRA calculator you can use to model and estimate the balance of your IRA over time.

Calculate your earnings and more. You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Currently you can save 6000 a yearor 7000 if youre 50 or older.

Use our Roth IRA calculator to determine how much can be saved for retirement. Compare Investments and Savings Accounts. Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth.

See the impact of regular contributions different rates of return and time in the market. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. New Look At Your Financial Strategy.

Visit The Official Edward Jones Site. Use our IRA calculators to get the IRA numbers you need. Your retirement is on the horizon but how far away.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. By increasing your contribution from 1000 to the maximum allowed.

Get a quick estimate of how much you could have to spend every month and explore ways to impact your cash flow in retirement. The Roth IRA provides truly tax-free growth. Creating a Roth IRA can make a big difference in your retirement savings.

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. There are two basic types of individual retirement accounts IRAs.

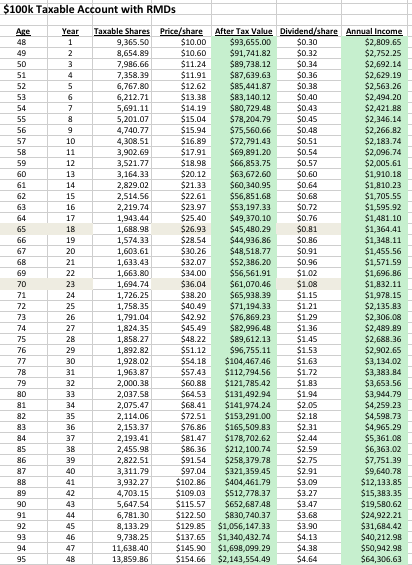

This online IRA Growth and Distribution Calculator which has been updated to conform to the SECURE Act of 2019 will attempt to. While long-term savings in a Roth IRA may. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs.

Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Visit The Official Edward Jones Site. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. IRA Distribution Calculator for Retirement Planning. There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from.

An IRA can be an effective retirement tool. Beginning in 2009 the contribution limit will adjust annually. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

New Look At Your Financial Strategy. Calculate IRA growth and. Use our IRA Contribution Calculator to see how making the maximum contribution to an IRA can affect your retirement.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Is the gain or loss for any.

Traditional Vs Roth Ira Calculator

Ira Growth And Distribution Calculator Retirement Planning Tool

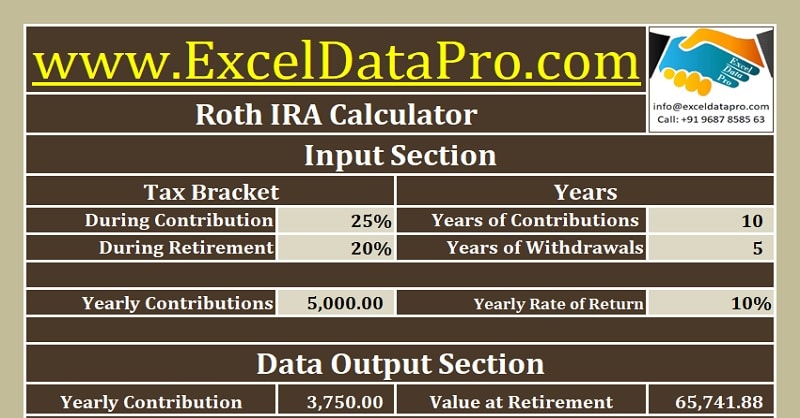

Download Roth Ira Calculator Excel Template Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

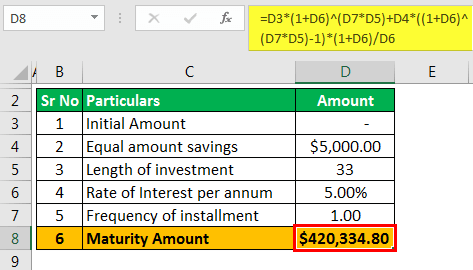

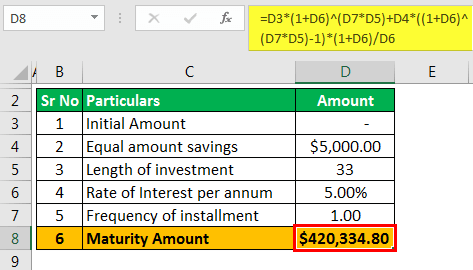

Traditional Ira Calculator Calculate Maturity After Retirement

Roth Ira Calculator Roth Ira Contribution

Ira Calculator See What You Ll Have Saved Dqydj

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

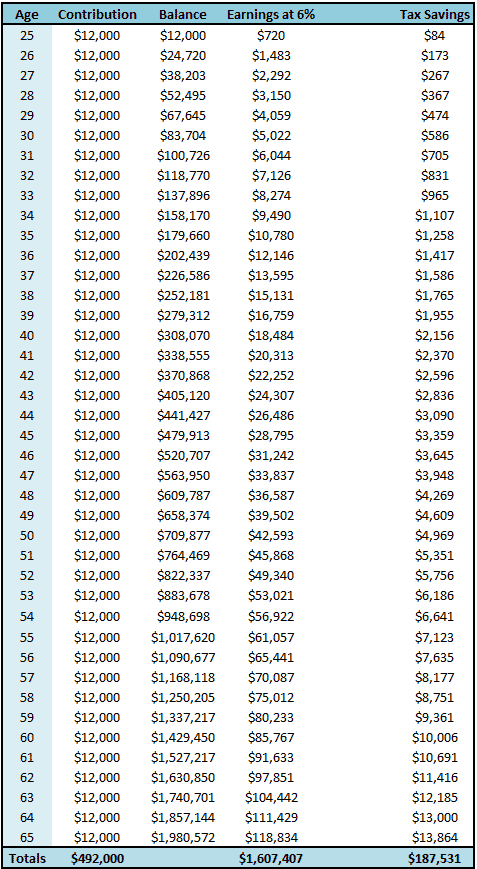

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Should I Convert My Dividend Growth Ira To A Roth Ira Seeking Alpha

Roth Ira Calculators

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq